Our PROJECTS

MERLIN KIMBERLITE

—project

About the project

In the top end of Australia, approximately 720 kilometres south-east of Darwin, lies the Merlin Diamond Project.

It was acquired in 2021 for A$8.5 million by Australian Natural Diamonds, a wholly owned subsidiary of Lucapa.

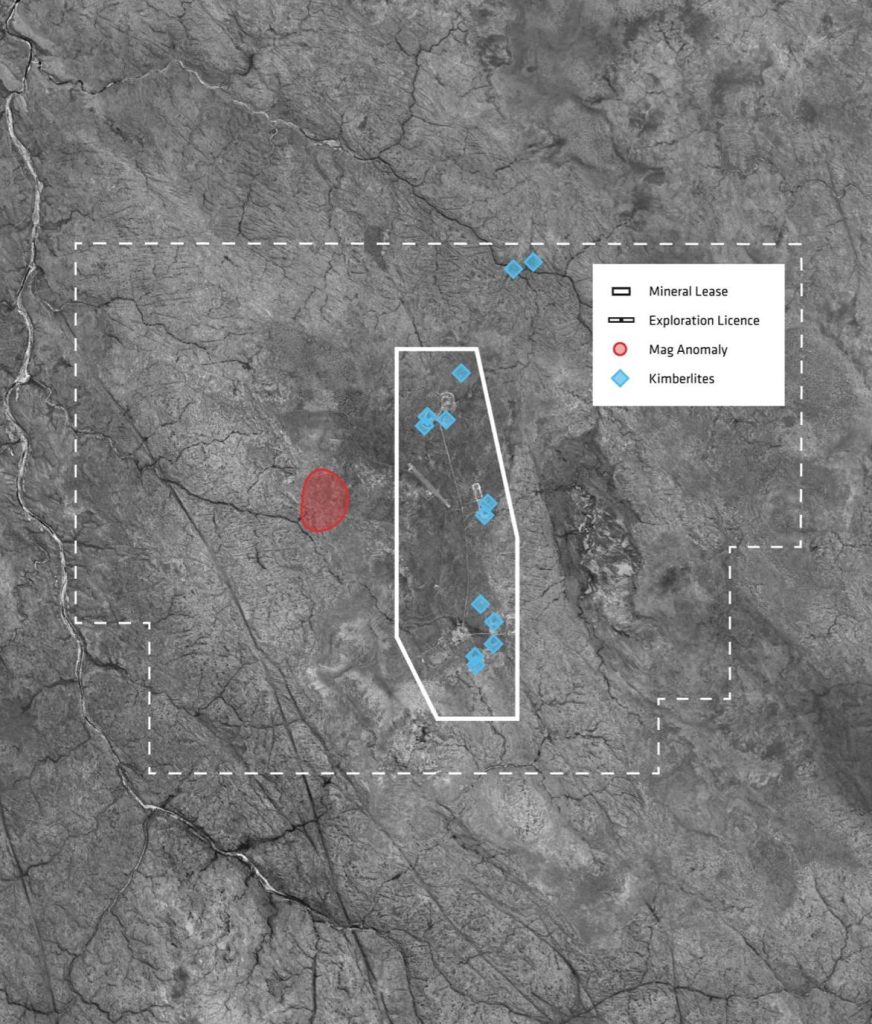

Merlin encompasses two tenements consisting of a 24 km2 mineral lease and 210 km2 exploration licence which encompasses the mineral lease. The Mineral Lease contains 11 previously discovered kimberlite pipes in three clusters namely North, Centre and South.

Eight of the 11 known kimberlite pipes at Merlin were mined by Rio Tinto and Ashton Mining between 1999 and 2003 producing 500,000 carats of diamonds from 2.2 million tonnes of treated kimberlite.

Each of the Merlin Kimberlites are named after a Knight of King Arthur’s Round Table; Gawain, Excalibur and Perceval to name a few.

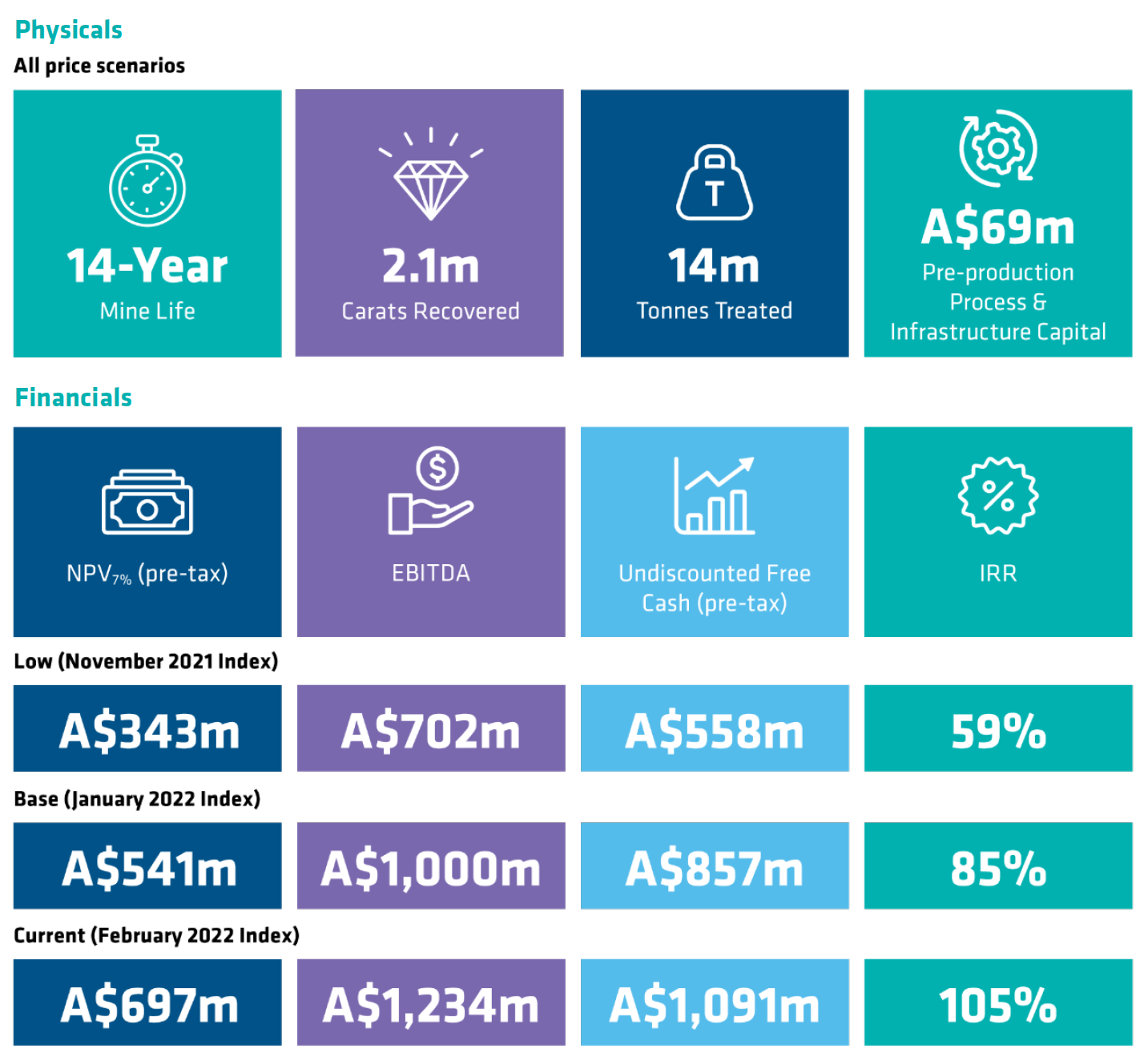

In 2022, a Scoping Study for Merlin was completed which reinforced the significant economic potential of the project.

In November 2023, Lucapa announced that the large scale Merlin Feasibility Study was on pause in favour of advancing an alternative study which focuses on a smaller scale, lower cost pathway to development. The Merlin production re-start plan was published in November 2024.

About the project

Exploration activities at Merlin have commenced to identify other kimberlite targets on the tenements.

The existing resource, which is based on Rio Tinto data, contains 27.8 million tonnes at an average grade of 16 carats per hundred tonnes for 4.4 million contained carats. Together, the mineral lease and exploration licence contain more than 70 reported but unresolved geophysical and geochemical anomalies, giving potential for further kimberlite discoveries.

Merlin’s camp has been recommissioned and services such as access roads, power, water and communications re-established. The site includes a 2.4 km airstrip, mine infrastructure and processing equipment.

In 2022, Native Title Assignment deeds in relation to the Mineral Lease and the Exploration Licence were executed between Australian Natural Diamonds, the Traditional Owners and the Northern Land Council. In 2022, the Mineral Lease was renewed for 25 years until 2047.

MERLIN JORC CLASSIFIED DIAMOND RESOURCE — 31 DECEMBER 2023

LUCAPA 100% ATTRIBUTABLE

| RESOURCE CLASSIFICATION | DATE | TONNES (MT) | GRADE (CPHT) | CARATS (MILLION) |

|---|---|---|---|---|

| Indicated | 31-Dec-23 | 13.4 | 17 | 2.28 |

| Inferred | 14.4 | 15 | 2.07 | |

| TOTAL | 27.8 | 16 | 4.35 |

(i) Mineral Resource reported in Lucapa’s ASX announcement “Acquisition of Merlin Diamond Project and A$23M Capital Raising” on 24 May 2021. No changes to the resource have been made since.

(ii) Mineral Resource grades based on previous mining operations recovery using a +0.95mm slotted bottom screen and +50–1C cut-off;

(iii) Insufficient grade data available to determine +5DTC cut-off grade for Tristram and Bedevere pipes therefore full-cut-off grades are used;

(iv) Rounding of tonnage and carats may result in computational inaccuracies.

historic recoveries

Merlin is home to Australia’s largest diamond which was recovered in 2002 from the Gareth pipe. The 104 carat Type IIa white diamond was cut into 26 individual polished diamonds.

Mine to market

Largest diamond to be recovered in Australia

Rough

104ct

The largest diamond ever recovered in Australia was from the Gareth Pipe at the Merlin Mine in March 2002. It was given the name “Jungiila Bunajina” by the Traditional Owners, which means

“star meteorite dreaming stone”.

Polished

26

The “Jungiila Bunajina” diamond

was sold and cut and polished into

26 separate diamonds of varying

shapes and sizes.